In brief

Presentation

The world of energy is rapidly changing, seeking for substitutes for oil and gas resources. This transition requires skillful and versatile people, able to tackle the economic and financial challenges taking into account the technical requirements of a highly innovative sector.

Our Energy Technology Economics and Management program will provide you with multifaceted expertise, recognized for the ability to fully grasp the economic challenges within the sector. You will receive customized training developed in cooperation with renowned international academic partners, and you will work within a multicultural and pluridisciplinary environment that will advance your career on an international scale. Energize your potential!

Main partners

Among these companies, the following have been IFP School partners in recent years (non-exhaustive list):

- Axens

- EDF

- Engie

- ExxonMobil

- International Energy Agency

- Natixis

- Perenco

- Saudi Aramco

- Schlumberger

- TechnipFMC

- TotalEnergies...

The key points of the program

Career prospects for graduates

Program & planning

Program at IFP School

Students attend two terms at IFP School, from January to mid-July. The program, taught in English, covers three main themes:

Business and management

-

Business accounting

-

Strategic management and marketing

Energy

- Energy geopolitics

- Upstream business

- Downstream management

- Electricity management

- Climate change economics

- Energy markets and trading

- Renewable energies techno-economics

- Reservoir engineering and geosciences

- Refining and process engineering

Quantitative tools applied to energy

-

Energy systems modeling

-

Decision science and optimization

-

Financial econometrics and forecasting

-

Energy and digitalization.

Program of the partner institutions

The Energy Technology Economics and Management program is organized in collaboration with partner universities. Students must attend a fall term in one of the following partners, in the case of “Single degree + internship” track:

- Audencia Business School (France) (possibility of a joint degree)

- CEPMLP – University of Dundee (Scotland)

- China University of Petroleum at Beijing (China)

- ESSEC Business School (France)

- KEDGE Business School (France)

- Rabat Business School – International University of Rabat (Morocco)

- Skoltech (Russia)

- University of Sao Paulo (Brazil)

When attending two fall terms in one of the following institutions, successful students are awarded two degrees.

- Colorado School of Mines: Master of Science in Mineral and Energy Economics

- micro/macro-economics

- mineral asset valuation

- energy economics

- etc.

- Gubkin University of Oil and Gas: Master of Economics

- micro/macro-economics

- petroleum economics

- mathematics and statistics

- risk management, asset portfolio building

- etc.

- The University of Oklahoma: MBA program

- managerial economics

- marketing

- financial analysis

- business strategy

- etc.

- Texas A&M University: Master of Engineering in Petroleum Engineering

- reservoir engineering

- fluid flows

- drilling

- production

- EOR

- etc.

Note that for the dual degree tracks, applicants must fulfill the requirements of both institutions. In particular, applicants to US partners must provide a valid GRE or GMAT score to apply for the dual degree.

More info about GRE or GMAT can be found via these links.

Schedule

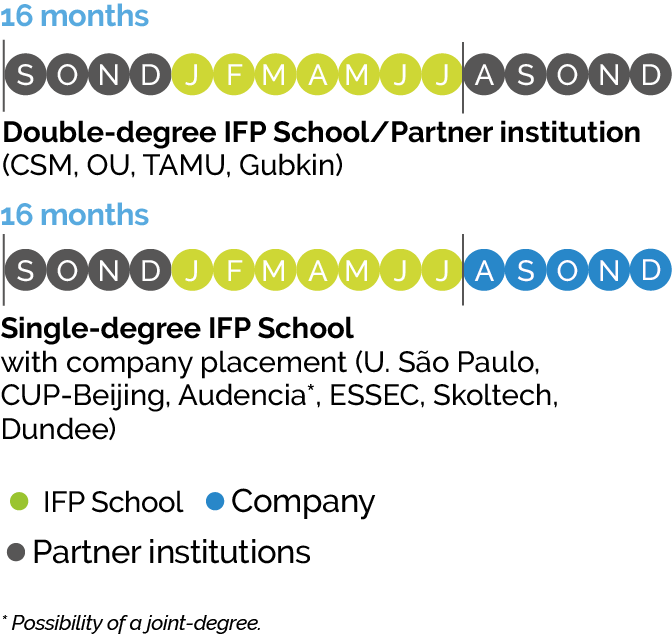

The two examples of schedules shown below correspond to the most frequently encountered cases for students in this program: 16-month program for students with a 4- or 5-year degree

- with two terms on the partner’s campus (CSM, OU, TAMU, Gubkin) to obtain a double-degree

- or with one term on the partner’s campus (all other partner institutions) and a placement period in a company for the IFP School single-degree track.

Career opportunities

Fields

- Energy business and economics

- Strategic management and marketing

- Management consulting and analytics

- Energy finance, banking and trading

- Energy techniques and engineering

Jobs

A few examples:

- Energy industry analyst, market economist: analysis of the oil, gas and electricity markets. Price and volume forecasts; market studies; etc.

- Project economist: energy project profitability study (upstream, downstream, power and renewables) and feasibility studies

- Trader/assistant trader and energy buyer (back, middle or front office): hedging tools and physical flows management

- Consultant: project studies, integration of environmental constraint in corporate policy, risk management